EUPD Research recently published the results of the 13th edition of the Global PV InstallerMonitor 2020/2021© for the French market. The survey sheds light on the rooftop photovoltaic (PV) segment in France, and provides exclusive insights from the perspective of the PV installers.

The PV market in France is yet again amongst the largest in Europe in terms of new PV installations. Furthermore, there is good news in terms of energy storage. Nearly two thirds of the French PV installers have now included energy storage solutions in their portfolios. This is a clear sign that rising electricity prices and the demand for electric vehicles is creating further business cases for the market intermediaries.

Bonn, 04. May 2021

The French PV market is one of the pioneering markets in Europe, and has been through various up- and downward trends over the last decade. In 2020, nearly a gigawatt of PV capacity was installed, which makes France the fifth-largest market in 2020 behind Germany, the Netherlands, Spain and Poland.

The cumulative PV power in France reached 10.9 GW by the end of 2020 while the French market benefitted from a further slight year-on-year growth, a trend that has continued since 2017. Last year almost 85% of the new PV plants were installed in the residential segment (below 9kW), and accounted for around 11% of the total installed capacity in 2020[i].

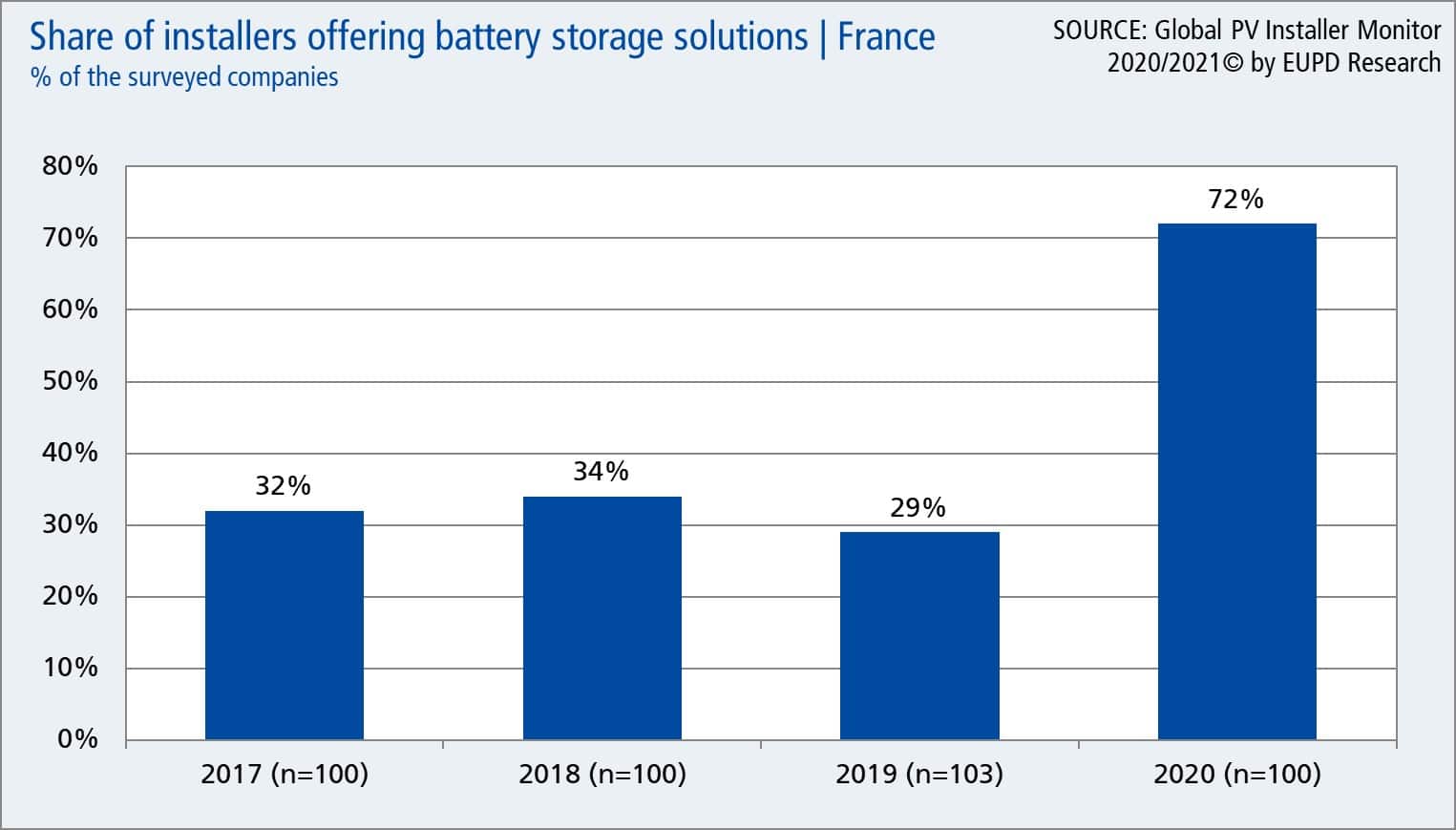

One topic that has been a market driver in various European rooftop markets, but so far has not yet been a real issue in France, is energy storage. Over the last 12 months, a broad share of French PV installers have started including battery storage solutions in their portfolio, as the Global PV InstallerMonitor 2020/2021© by EUPD Research reveals. While in 2019 the share was merely 29%, in 2020 nearly three quarters of the surveyed installers are offering storage systems to their customers (72%). A further 19% of the installers plan to include storage solutions by the end of 2021.

The small share of installers that still refused to offer energy storage systems, mainly claims that the current prices are too high. Other topics such as high training demands, concerns about the technological maturity or the environmental impact of the systems, or even a lack of demand are currently hardly an issue.

The significant boost in the share of installers, who are now offering storage solutions, has various reasons. Amongst them the most compelling ones are the continuously increasing electricity prices for private households in France on the one hand[i]; and on the other hand the increased amount of electric vehicle registrations[ii], which consequently leads to subsequent PV and energy storage installations, in order to charge the car with self-generated electricity.

This year’s version of the Global PV InstallerMonitor 2020/2021© for the French market examines the recurring topics such as which module-, inverter- or storage brands installers carry in their portfolio, how and where they purchase their components, and to which extent they are satisfied with the brands they offer. A short section about electric mobility is included in the report as well.

Graph: Share of French installers that are offering battery storage solutions from 2017 to 2020.

About the Global PV InstallerMonitor 2020/2021©

The 13th edition of the study conducted by EUPD Research deals with the topics of brand management, market penetration, procurement and satisfaction with respect to modules, inverters, wholesalers and storage systems. EUPD Research surveyed a total of 1,100 PV installers in Australia, Austria & Switzerland, Belgium, France, Germany, Italy, the Netherlands, Poland and Spain. Many evaluations are displayed on a brand level.

Further information about the study can be viewed here. If you have any questions, please contact Saif Islam, Senior Consultant at EUPD Research, under + 49 228 97143-20 and .