EUPD Research will publish the results of the 13th edition of the Global PV Installer Monitor 2020/2021© for the Polish market. In 2020, more than half of the Polish installers procured their PV modules through specialized wholesalers. Local wholesalers and PV manufactures are holding a strong position on the market. Competition is expected to strongly increase in the coming years.

Bonn, 4 February 2021

The results of the 13th edition of the Global PV Installer Monitor 2020/2021© will be published by EUPD Research this month. The survey targets PV installers in the main European PV markets plus Australia. For the first year, 101 Polish installations companies took part in the survey. The report provides exclusive insights on the latest developments in the rooftop PV segment in one of the most promising Eastern European country markets.

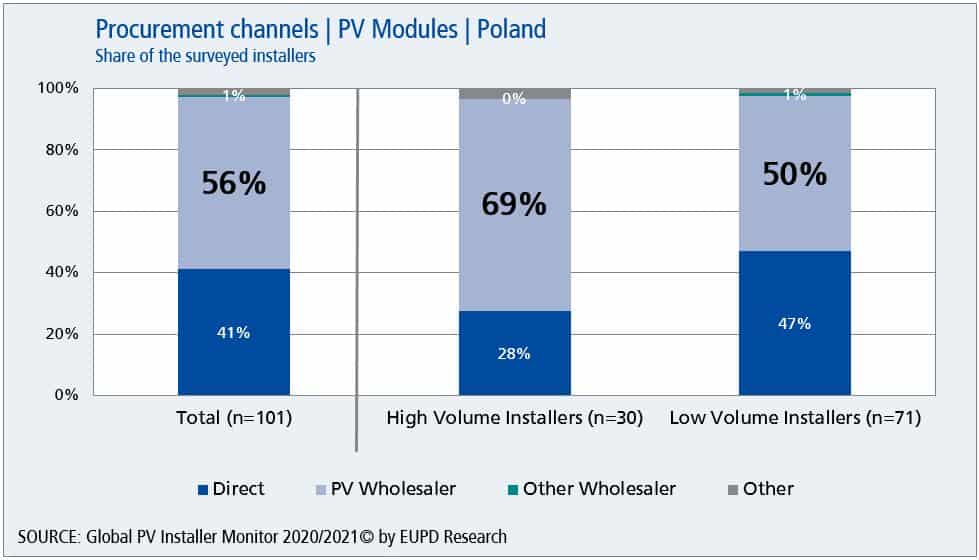

One section of the report analyses procurement management for PV module. The latest results show that the majority of the surveyed installers procured their PV modules through specialized PV wholesalers last year. This result holds true both for high and low volume installers. In fact, more than two-thirds of high volume installers procured their modules through specialized PV wholesales and half of low volume installers did likewise.

Graph 1: on average 56% of the Polish installers purchased their modules through specialized PV wholesalers

This contrasts with procurement patterns in more mature PV markets, such as Spain and Italy, where manufactures developed partnerships with local installers in order to increase margins and offering flexible credit solutions. A more detailed analysis shows that among the top eight wholesalers there are six Polish companies, one of them leading the ranking.

A similar trend can also be identified considering the module brands that most of the Polish installers carry in their portfolio. In fact, even is most of the Polish installers carry global leading brands in their portfolio, two local module manufactures are holding a strong position on the Polish market.

Finally, installers are concerned about high prices for each of the top 10 module brands. In a PV market with a residential segment that is growing by more than 600 MW each year we expect competition to strongly increase in the coming years.

The results of the latest edition of the Global PV Installer Monitor 2020/2021© will be presented by Davide Pesenti, Research Consultant at EUPD Research, on Thursday, 4 February 2021, during the “Downstream Market Briefing 2021 – Poland” hosted by the Solar & Storage DigiCon. Registration is FREE here.

This year’s version of the Global PV InstallerMonitor 2020/2021© for the French market examines the recurring topics such as which module-, inverter- or storage brands installers carry in their portfolio, how and where they purchase their components, and to which extent they are satisfied with the brands they offer. A short section about electric mobility is included in the report as well.

About the Global PV InstallerMonitor 2020/2021©

The 13th edition of the study conducted by EUPD Research deals with the topics of brand management, market penetration, procurement and satisfaction with respect to modules, inverters, wholesalers and storage systems. EUPD Research surveyed a total of 1,100 PV installers in Australia, Austria & Switzerland, Belgium, France, Germany, Italy, the Netherlands, Poland and Spain. Many evaluations are displayed on a brand level.

Further information about the study can be viewed here. If you have any questions, please contact Davide Pesenti, Research Consultant EUPD Research, at + 49 228 97143-35 | .