The Netherlands are among the top European countries when it comes to public charging stations for electric vehicles. Furthermore, private charging stations and solutions for electric mobility in the private sector are also very important. The number of photovoltaic (PV) installers offering electric mobility solutions has increased since 2019. These and further results are published in the 13th edition of the Global PV InstallerMonitor 2020/2021©. The survey sheds light on the rooftop PV segment in the Netherlands, and provides exclusive insights from the perspective of the PV installers.

Bonn, 28. April 2021

The public charging infrastructure in Europe is on the rise. The Netherlands is among the top countries. According to data from the European Alternative Fuels Observatory there are more than 66,600 public charging stations in the Netherlands. Additionally, electric mobility solutions for the private sector are also very popular.

Electric mobility is becoming an increasingly important topic, especially in combination with PV. One section of the Dutch version of the Global PV Installer Monitor 2020/2021© is dedicated to electric mobility. The Global PV InstallerMonitor 2020/2021© targets PV installers in the main European PV markets and Australia. This year, 106 Dutch installation companies participated in the survey. The report provides exclusive insights on the latest developments on the rooftop PV segment in the Netherlands.

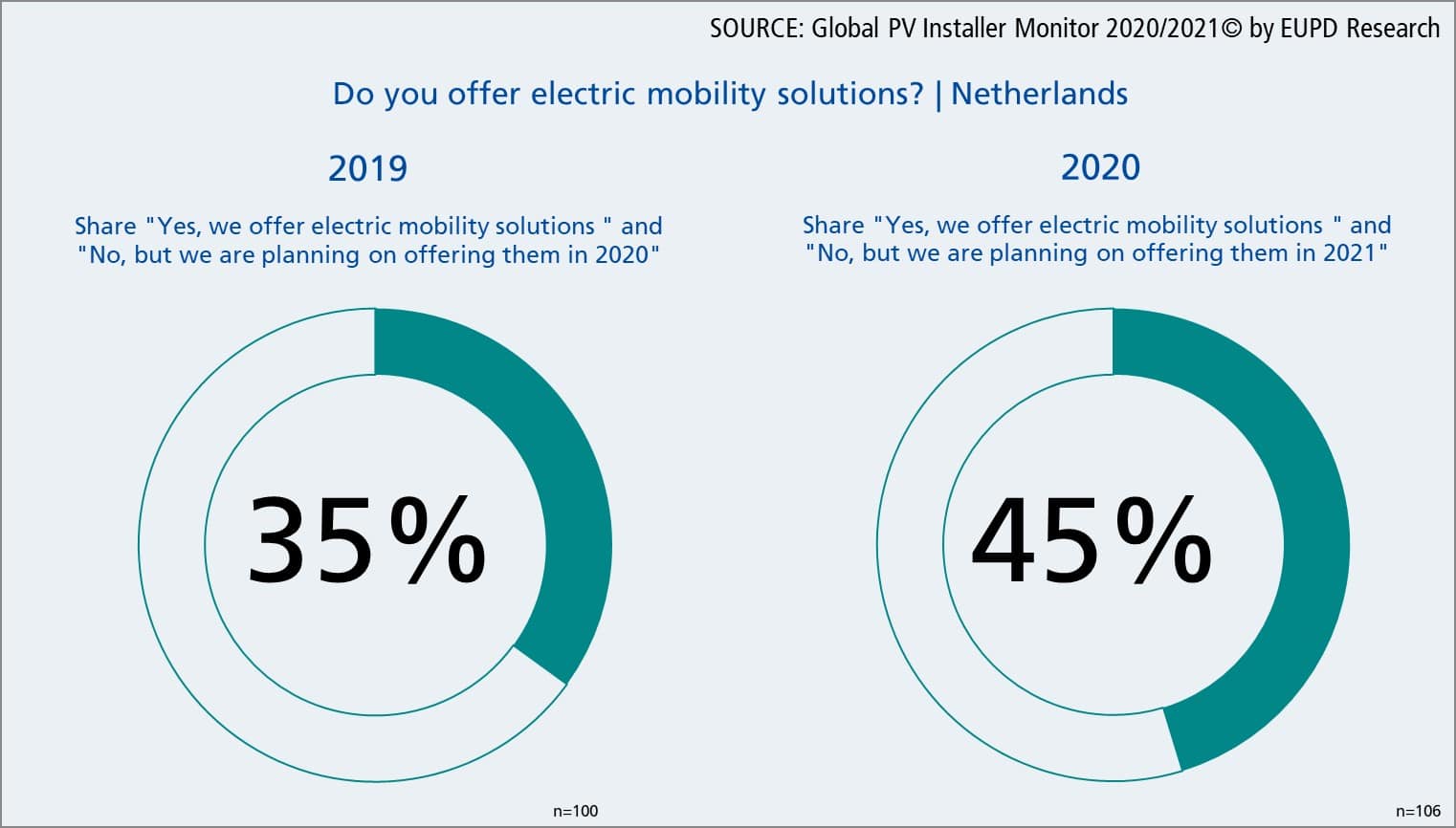

Installers of PV systems have started to implement electric mobility solutions in their portfolios. It is noticeable that the share of Dutch PV installers offering electric mobility solutions has increased by 10 percentage points compared to 2019.

In 2020, 34 percent of the participants already offer electric mobility products and 11 percent of the surveyed installers are planning to do so in 2021. Therefore, a little more than half of the surveyed companies are not interested in electric mobility solutions. The main reason why Dutch installers are not offering charging stations for electric vehicles is that they do not see it as part of their business. Currently high prices, low margins and a not convincing technological maturity only play a minor role for not offering electric mobility products. Even the development is noticeable, as there is still a potential for private electric mobility solutions offered by PV installers compared to an already strong public charging infrastructure in the Netherlands.

Additional to the section about electric mobility, this year’s version of the Global PV InstallerMonitor 2020/2021© also examines the recurring topics of the report such as which module-, inverter- or storage brands installers carry in their portfolio, how and where they purchase their components, and to which extent they are satisfied with the brands they offer.

About the Global PV InstallerMonitor 2020/2021©

The 13th edition of the study conducted by EUPD Research deals with the topics of brand management, market penetration, procurement and satisfaction with respect to modules, inverters, wholesalers and storage systems. EUPD Research surveyed a total of 1,100 PV installers in Australia, Austria & Switzerland, Belgium, France, Germany, Italy, the Netherlands, Poland and Spain. Many evaluations are displayed on a brand level. Further information about the study can be viewed here. If you have any questions, please contact Saif Islam, Senior Consultant at EUPD Research, under + 49 228 97143-20 and s.islam(at)eupd-research.com