The market for charging stations for electric vehicles is vast and diverse. Installers play a crucial role in the decision-making process of which charging station brand to install. Therefore, it is essential to understand why installers choose a brand and how likely they are to recommend the brand. EUPD Research has conducted a survey of 800 electric vehicle charging station installers across Germany, Austria, Switzerland, and the United Kingdom for its latest study ‘Market Monitor Charging Stations for Electric Vehicles© 2022/2023’. The survey indicates that high quality is the main reason for offering certain brands in installer portfolios and surveyed installers show high recommendations for the brands in their portfolios.

Bonn. The market for electric vehicle charging stations is huge. In Germany alone, there are more than 900 different charging station models listed in the cosmix database (according to their website: Europe’s largest database for charging infrastructure). In Europe, the growing demand for electric vehicles has led to an increase in the number of installed charging stations. Installers are essential decision-makers when it comes to which charging station brands are installed, making it important to understand the preferences of the installers.

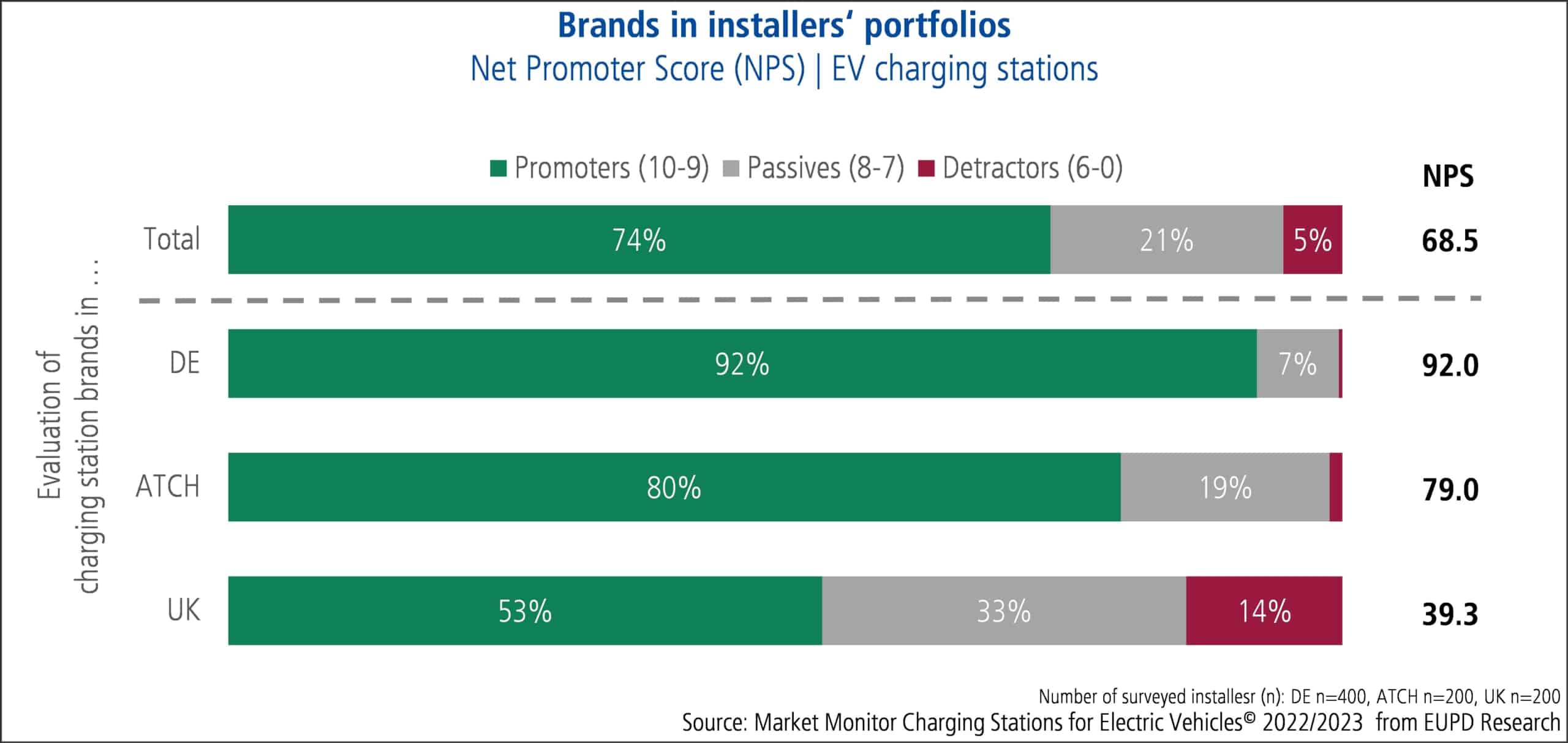

The EUPD Research study ‘Market Monitor Charging Stations for Electric Vehicles© 2022/2023′ surveyed 800 electric vehicle charging station installers in Germany, Austria, Switzerland, and the United Kingdom (UK). The study provides insights into the charging station market and the role of installers in the decision-making process. In addition, the installers’ experience with different brands is important in assessing how likely they are to recommend a certain brand. In total, there are almost 1,400 brand evaluations from 800 surveyed installers in the current study. 74 percent of the evaluations are related to brand promoters, and five percent of the evaluations are from brand detractors, resulting in an overall Net Promoter Score (NPS) of 68.5. 21 percent of the evaluations are from passives who would neither recommend nor not recommend the respective brand. Only promoters and detractors are taken into account for the NPS calculation[1]. Among surveyed country markets, the NPS is highest in Germany at 92.0, followed by Austria and Switzerland at 79.0, and the United Kingdom at 39.3.

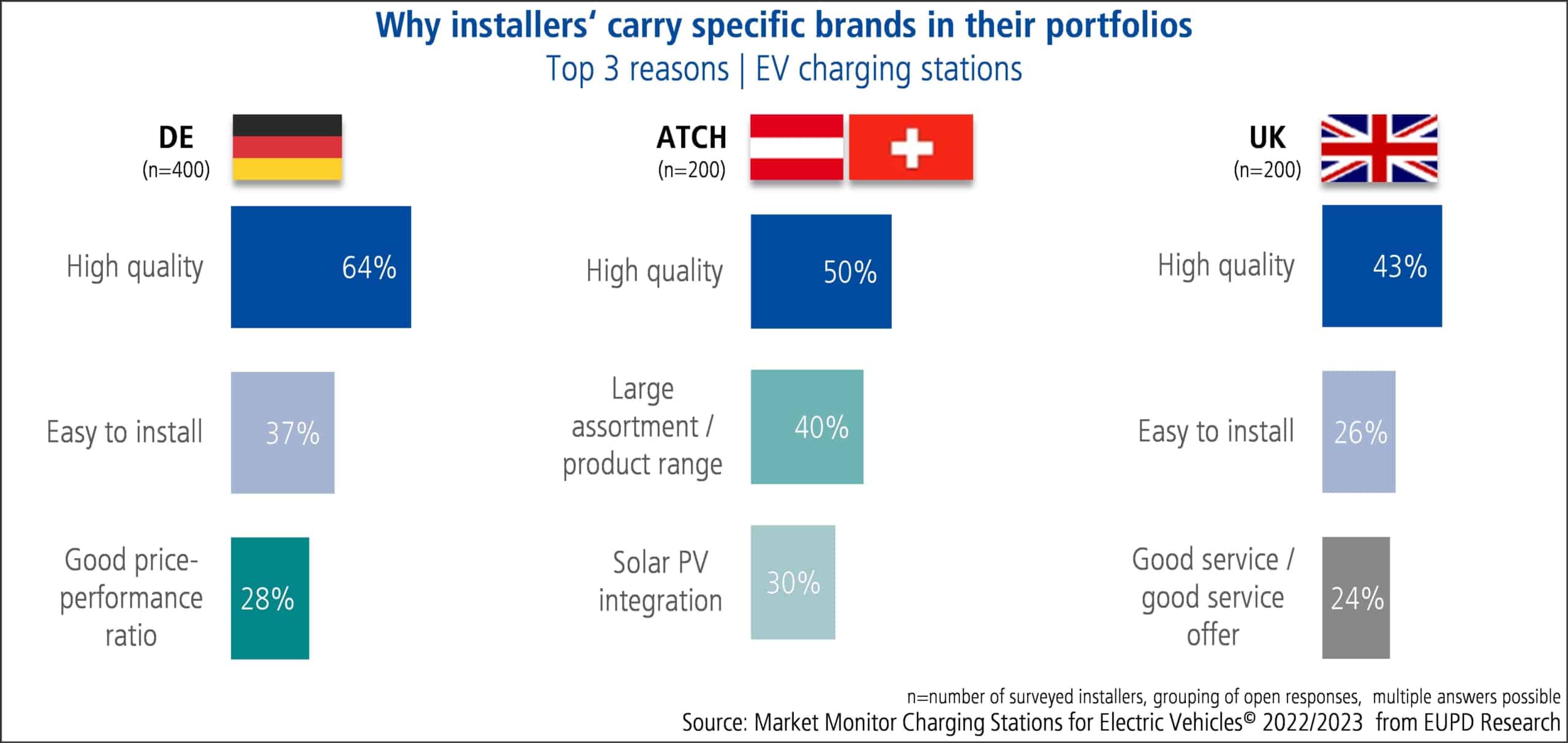

The study also gives more insights about the reasons why installers offer certain brands in their portfolios. Even though thecountry markets have different demands and needs for charging station products, there are similar trends across the countries. High quality was found to be the main reason for including brands in portfolios in all surveyed countries. Other top reasons include ‘easy to install’, ‘good price-performance ratio’, ‘large assortment / product range’, and ‘good service / good service offer’. Additionally, in Austria and Switzerland, ‘solar PV integration’ is listed as a top three reason, which is also among the top 10 reasons in the other surveyed countries. Charging stations as part of the sector coupling technologies are becoming increasingly important and to increase PV self-consumption is one of the most important market drivers. Therefore, it is crucial that the charging stations are compatible with the PV systems and that PV system owners are able to use their own generated electricity to charge their electric vehicles.

‘The survey results show the importance of offering a wide range of products and services to meet the diverse needs of installers and end users. In addition, the high recommendation willingness of installers for brands of EV charging stations reflects the importance of trusted partnerships in the industry’, comments Christine Koch, project manager at EUPD Research.

About the ‘Market Monitor Charging Stations for Electric Vehicles© 2022/2023’

The ‘Market Monitor Charging Stations for Electric Vehicles© 2022/2023′ is EUPD Research’s second edition of this study. Thestudy creates transparency in the market for electric vehicle charging stations and provides a unique and up-to-date knowledge about suppliers, dealers and installation companies. Besides a comprehensive market overview of suppliers, products and dealers, the study also quantifies procurement channels. The installer survey is the core element of the study and reveals the important experiences and evaluations of charging station installations from the installers’ perspective. Among other things, this includes the presentation of the installer portfolio, brand management, procurement management and market development.

If there are any questions, please contact Leo Ganz, Partner at EUPD Research at +49 30 880 600-71 or l.ganz(at)eupd-research.com.

[1] NPS = share of promoters – share of detractors