EUPD Research recently published the results of the Global PV InstallerMonitor 2021/2022© for the South African market for the very first time. The survey sheds light on the photovoltaic (PV) segment in South Africa and provides exclusive insights from the perspective of the PV installers.

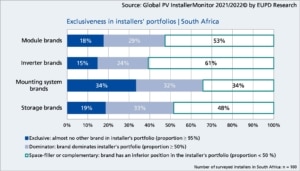

The main drivers of the PV market in South Africa are the small-scale embedded generation (SSEG) and the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) in the large-scale segment. Apart from the ups and downs of the market in recent years, South Africa shows a great potential for photovoltaics. In terms of PV components, nearly half of the installers offer brands exclusively, or they at least select certain brands that dominate their product portfolios.

Bonn, 2 May 2022

South Africa takes the leading role in the PV development on the African continent, however, the country has faced challenges in the past to move forward in terms of PV development. Nevertheless, the country offers a great potential with more than 2,500 hours of sunlight a year. EUPD Research estimates the cumulative capacity to have reached about 4 GW by the end of 2021, with around 741 MW of newly installed PV capacity in 2021. Most of the new capacity was added through the REIPPPP scheme for large-scale installations, while distributed generation (small-scall installations) with the SSEG program is gaining in importance. Solar energy plays a key role in the government’s Integrated Resource Plan (IRP), a roadmap detailing South Africa’s decarbonization and energy mix by 2030. With this, the cumulated solar PV capacity (large-scale) in South Africa is expected to reach 8.288 GW by 2030.[1]

The Global PV InstallerMonitor 2021/2022© by EUPD Research targets installers in selected core PV markets. This year, 100 South African installation companies participated in the survey. The report offers exclusive insights into the latest developments with regard to PV components and brands in South Africa.

The results regarding the exclusiveness among all PV component brands offered in the installers’ portfolios show that nearly half of the surveyed installers in South Africa offer a specified portfolio (exclusive or dominating brands), while the other half provide a diversified product portfolio (mostly complementary or space-filler brands) to their customers. When brands per technology are considered, it appears that 47 percent of installers surveyed offer module brands exclusively or dominantly in their portfolios, while for inverter portfolios this is the case in 39 percent, mounting systems at 66 percent, and storage at 52 percent.

In addition to the proportion of brands in the portfolios, installers were asked about their satisfaction (on a scale of 1 to 5) with the PV brands. The results of the average satisfaction show that the surveyed installers are satisfied with the products and brands they offer. The average values for the different technologies range from “satisfied = 2” to “very satisfied = 1”. Here, inverters and storage achieve an average satisfaction of 1.39, while satisfaction with modules is slightly lower on average (1.61). Detailed information about the most important PV brands in South Africa are presented in the full report, in order to find out more about the differences between the various brands.

This year’s version of the Global PV InstallerMonitor 2021/2022© for the South African market focuses on the recurring topics such as which module-, inverter- or storage brands installers carry in their portfolio, how and where they purchase their components, and to which extent they are satisfied with the brands they offer. For the first time, installers were also surveyed in regards to which mounting structure manufacturers they know, offer, and are willing to recommend.

About the Global PV InstallerMonitor 2021/2022©

The 14th edition of the study conducted by EUPD Research deals with the topics of brand management, market penetration, procurement, and satisfaction with respect to modules, inverters, wholesalers, and storage systems. EUPD Research surveyed a total of more than 1,500 PV installers in Australia, Austria & Switzerland, Belgium, France, Germany, Italy, the Netherlands, Poland, and Spain, as well as in Brazil, South Africa, and the United States (California). Many evaluations are displayed on a brand level. Further information about the study can be viewed here or watch the video.

If you have any questions, please contact Saif Islam, Senior Consultant at EUPD Research, under + 49 228 97143-20 and s.islam(at)eupd-research.com.

[1]

Department of Mineral Resources and Energy South Africa (2019): Integrated Resource Plan (IRP2019)

Ralphs Photo by Pixabay

Ralphs Photo by Pixabay