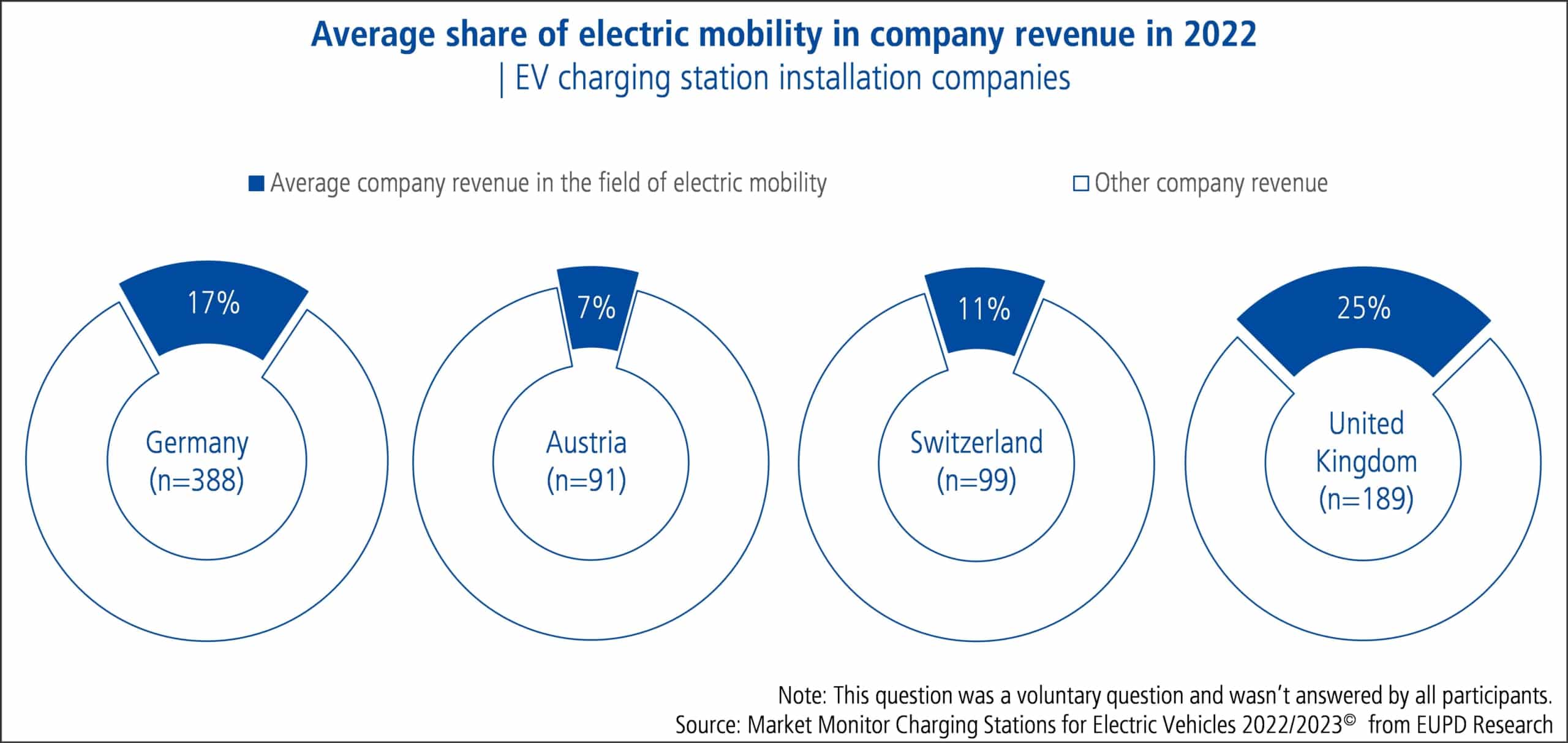

Record numbers of new registrations of battery electric vehicles are driving a strong demand for charging infrastructure and offer installers an attractive order backlog. With the growing number of charging infrastructure products available, it can be difficult to keep up with the market. EUPD Research conducted a survey of 800 electric vehicle charging station installers for its latest study ‘Market Monitor Charging Stations for Electric Vehicles 2022/2023©’ in Germany, Austria, Switzerland, and the United Kingdom. The surveyed installer companies in the respective countries indicated that electric mobility accounts for an average of seven to 25 percent of their total company revenue.

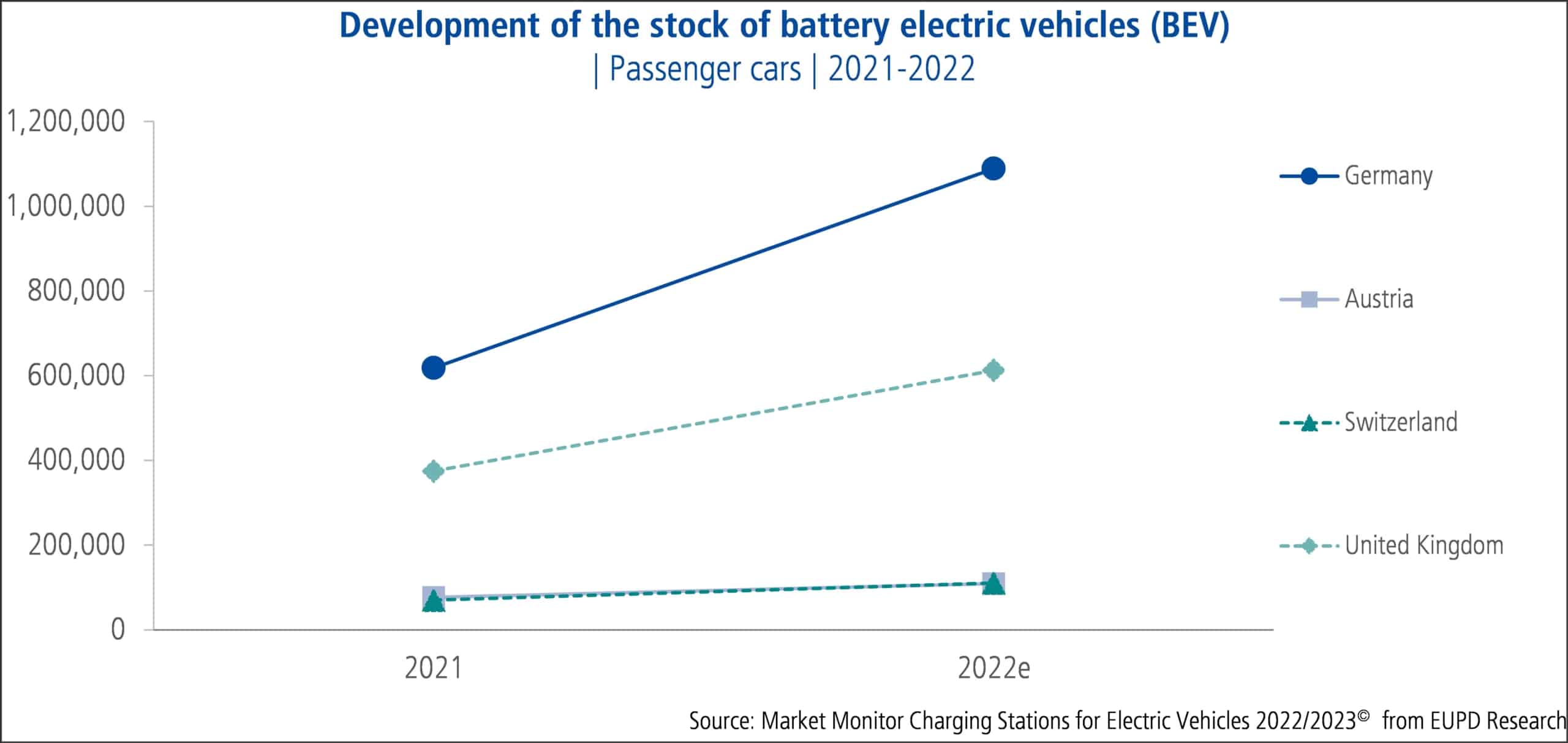

Bonn. The sales of electric vehicles among passenger cars has sharply increased in recent years, rising to nearly two million battery electric vehicles (BEVs) (up from 1.1 million in 2021) in Germany, Austria, Switzerland, and the United Kingdom. This growth has led to an increasing demand for charging infrastructure in private, commercial, as well as public sectors. Companies and governments are aware of the need to improve access to charging options for BEVs to meet this demand and to support the transition to emission-free mobility. Governments in Germany, Austria, Switzerland, and the United Kingdom have launched plans and initiatives to increase the availability of charging infrastructure and drive the transition to electric mobility.

For installation companies, this trend leads to exciting business opportunities. In the context of renewable energies in particular, only a few industries – amongst which are electric mobility and charging infrastructure – offer such attractive business opportunities. In a recent EUPD Research study, the ‘Market Monitor Charging Stations for Electric Vehicles 2022/2023©’, a total of 800 installers were surveyed in Germany, Austria, Switzerland, and the United Kingdom regarding the installation of charging infrastructure. A portfolio that includes technologies for sector coupling (such as PV, PV energy storage, heat pumps, charging infrastructure) has become increasingly valuable for installation companies.

The current survey results show that the average share of electric mobility in the company’s revenue ranges from seven to 25 percent in the surveyed countries. In comparison, the average company revenue is lower in Germany, Austria and Switzerland than in the UK. The differences can also be explained by the background of the installation companies. In the DACH region, the surveyed installation companies are primarily electrical installation companies that added the installation of charging infrastructure to their portfolio. In the UK, the average company revenue is slightly higher, because 13 percent of the surveyed companies are EV charging specialists, who make their main revenue from the installation of charging infrastructure.

Particularly in the home sector, there are special advantages for installation companies: More and more households are striving to create smart connections between solar power and electric mobility to reduce their own energy costs. Thus, installers have an advantage if they offer different components for sector coupling. In addition, surveyed installers report a high customer demand (both now and in the future), with the result that the majority of installation companies expect further revenue growth in the coming years.

“The topic of sector coupling in the installation portfolio is becoming increasingly important, which enables an installation company to offer several components within one order. However, this also confronts the industry with challenges in the coming years, resulting in high workloads for installers. In this context, the field time to gather data for this study has posed challenges to us with regard to the availability of installers. Thus, we are even more pleased to be able to present the results to you”, comments Christine Koch, Project Manager for ‘Market Monitor Charging Stations for Electric Vehicles’ at EUPD Research.

About the ‘Market Monitor Charging Stations for Electric Vehicles 2022/2023©’

The ‘Market Monitor Charging Stations for Electric Vehicles 2022/2023©’ is EUPD Research’s second edition of this study. This study creates transparency in the market for electric vehicle charging stations and provides a unique and up-to-date knowledge about suppliers, dealers and installation companies.

Besides a comprehensive market overview of suppliers, products and dealers, the study also qualifies and quantifies procurement channels. The installer survey is the core element of the study and reveals the important experiences and evaluations of charging station installations from the installers’ perspective. Among other things, this includes the presentation of the installer portfolio, brand management, procurement management and anticipated market development.

If you have any questions, please contact Leo Ganz, Partner at EUPD Research at +49 30 880 600-71 or l.ganz(at)eupd-research.com.